Open the Door to Homeownership: Financing 101

Congratulations! You've decided to embark on the exciting journey of homeownership. But before you start browsing open houses, understanding your financing options is crucial. Navigating the world of mortgages can feel overwhelming, with acronyms like FHA, VA, and USDA thrown around like confetti. Fear not, intrepid homebuyer! This guide will demystify the most common mortgage types and help you identify the perfect fit for your financial situation.

Congratulations! You've decided to embark on the exciting journey of homeownership. But before you start browsing open houses, understanding your financing options is crucial. Navigating the world of mortgages can feel overwhelming, with acronyms like FHA, VA, and USDA thrown around like confetti. Fear not, intrepid homebuyer! This guide will demystify the most common mortgage types and help you identify the perfect fit for your financial situation.

The Big Three: Financing Options for Every Buyer

-

Conventional Loans: The gold standard of home loans, conventional mortgages are offered by private lenders and adhere to guidelines set by Fannie Mae and Freddie Mac. These loans typically require a down payment as low as 5%. Conventional loans offer competitive interest rates and are a good choice for buyers with strong credit scores (typically above 670) and a steady income history.

-

FHA Loans: Backed by the Federal Housing Administration (FHA), these loans are designed to make homeownership more accessible for first-time buyers and those with lower credit scores (down to 580 with a 10% down payment). FHA loans require a lower down payment (as low as 3.5%), making them ideal for buyers who may not have saved a substantial amount for a down payment. However, FHA loans come with additional upfront costs like mortgage insurance premiums (MIP).

-

VA Loans: Exclusively for veterans, active-duty service members, and their eligible spouses, VA loans are a fantastic option with several advantages. Backed by the Department of Veterans Affairs (VA), these loans typically require no down payment and offer competitive interest rates. Additionally, VA loans don't come with private mortgage insurance, saving borrowers money in the long run. However, VA loans have specific eligibility requirements related to military service history.

Beyond the Big Three: Additional Financing Options

- Down Payment Assistance Programs: Numerous programs offered by state and local governments, as well as non-profit organizations, can help first-time homebuyers with down payment and closing cost assistance.

- Renovation Loans: These loans allow you to finance the purchase and renovation of a fixer-upper in one convenient package.

Finding the Perfect Loan Fit:

So, which loan is right for you? Here's a breakdown based on your situation:

- First-time buyer with good credit but limited down payment: Consider an FHA loan.

- Veteran with no down payment: Explore a VA loan.

- Low-income buyer: Research down payment assistance programs and explore FHA loan options.

Beyond the Loan Type: Additional Considerations

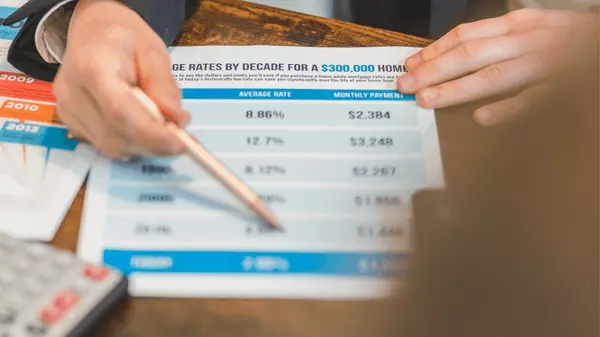

- Interest rate: Fixed-rate mortgages offer stability, while adjustable-rate mortgages (ARMs) may have lower initial rates but can fluctuate over time.

- Loan term: Typically 15 or 30 years, with shorter terms offering faster payoff but higher monthly payments.

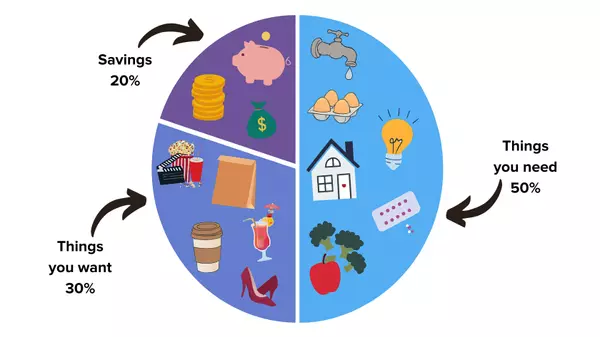

- Closing costs: These fees can vary depending on the lender and loan type. Be sure to factor them into your budget.

Seek Professional Guidance:

A qualified mortgage lender can help you navigate the intricacies of pre-approval, analyze your financial situation, and recommend loan options tailored to your needs. Don't hesitate to ask questions and compare different loan offers before making a final decision.

Remember: Purchasing a home is a significant investment, and choosing the right financing option is key. By understanding the different loan types and seeking professional guidance, you'll be well-equipped to conquer the mortgage maze and unlock the door to your dream home.

I hope this was helpful! See you next week!

Lissette Bolano | 781-521-6400 | lissette@reallissette.com | Rhode Island & Massachusetts Real Estate

Categories

Recent Posts

GET MORE INFORMATION