Seller's Market Sizzle: Can an Appraisal Gap Help You Snag Your Dream Home?

Congratulations! You've found the perfect house – a place that sparks joy and feels like "home." But wait, there's a catch: you're entering a seller's market. Low inventory and high demand can make securing your dream home a fierce competition. This is where the concept of an appraisal gap comes in, a strategy that might give your offer the edge. But before you dive headfirst, let's unpack what it means and how it can impact your homebuying journey.

Congratulations! You've found the perfect house – a place that sparks joy and feels like "home." But wait, there's a catch: you're entering a seller's market. Low inventory and high demand can make securing your dream home a fierce competition. This is where the concept of an appraisal gap comes in, a strategy that might give your offer the edge. But before you dive headfirst, let's unpack what it means and how it can impact your homebuying journey.

What's an Appraisal Gap, Anyway?

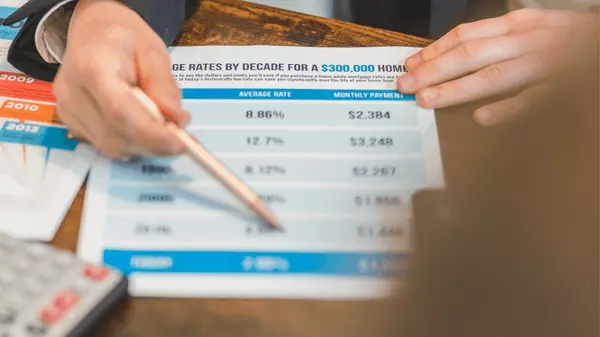

Imagine this: you fall in love with a house and submit an offer of $400,000. However, upon appraisal, the house is valued at $380,000. This $20,000 difference is the appraisal gap. Traditionally, a mortgage is based on the appraised value, not your offer price. So, in our example, the lender may only loan you $380,000, leaving you with the responsibility to cover the remaining $20,000.

Why Would I Agree to This?

A seller's market is a game of musical chairs – there are more eager buyers than available homes. An appraisal gap allows you to demonstrate your financial commitment. It essentially tells the seller, "Hey, I'm serious about buying your house, even if the appraisal comes in a bit lower." This can give your offer a significant edge in a competitive bidding war.

Friend or Foe? Unveiling the Pros and Cons:

The Allure of Appraisal Gaps (For Buyers):

- Boost Your Competitive Edge: In a seller's market, every bit counts. An appraisal gap contingency can make your offer more attractive, potentially winning you the keys to your dream home.

- Stand Out from the Crowd: Multiple offers? An appraisal gap shows the seller you're willing to go the extra mile to secure the property.

The Flip Side of the Coin (Buyer Beware):

- Financial Risk: This is the big one. If the appraisal gap is significant, you'll need to come up with the difference in cash – a hefty sum that can strain your finances.

- Loan Complications: Lenders may be hesitant to approve mortgages with large appraisal gaps. Ensure your lender is comfortable with this strategy before committing.

So, Is an Appraisal Gap Right for You?

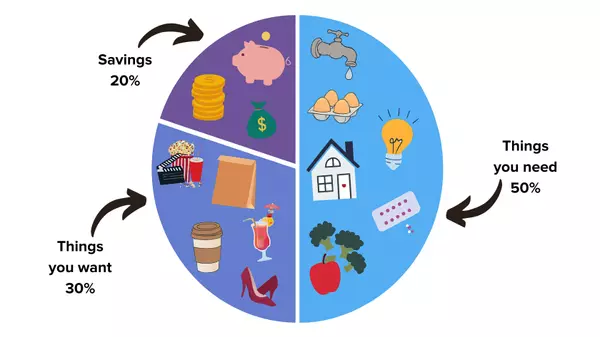

This is a personal decision that requires careful consideration. Here's the truth: an appraisal gap isn't for everyone. If the thought of a potential financial burden makes you nervous, there's absolutely nothing wrong with walking away. Remember, buying a house is a marathon, not a sprint. The perfect home will come along eventually, and you'll be glad you didn't overextend yourself.

Strategies for the Savvy Buyer:

- Negotiation is Key: Include an appraisal gap contingency clause in your offer. This allows you to renegotiate the price with the seller if the appraisal falls short.

- Be Financially Prepared: Have a financial cushion to cover a potential appraisal gap. This demonstrates responsibility to both the seller and your lender.

- Targeted Offers: Consider offering a lower initial price but with a smaller appraisal gap. This can lessen the financial risk while still showcasing your commitment.

The Takeaway: Knowledge is Power

Appraisal gaps can be a valuable tool in a seller's market, but they shouldn't be taken lightly. By understanding the pros and cons, and by having a solid financial plan in place, you can make informed decisions that lead you closer to your dream home. Remember, consulting a trusted real estate agent can be invaluable. They can guide you through the intricacies of the market and help you craft a winning offer strategy, appraisal gap or not.

Happy house hunting!

Categories

Recent Posts

GET MORE INFORMATION